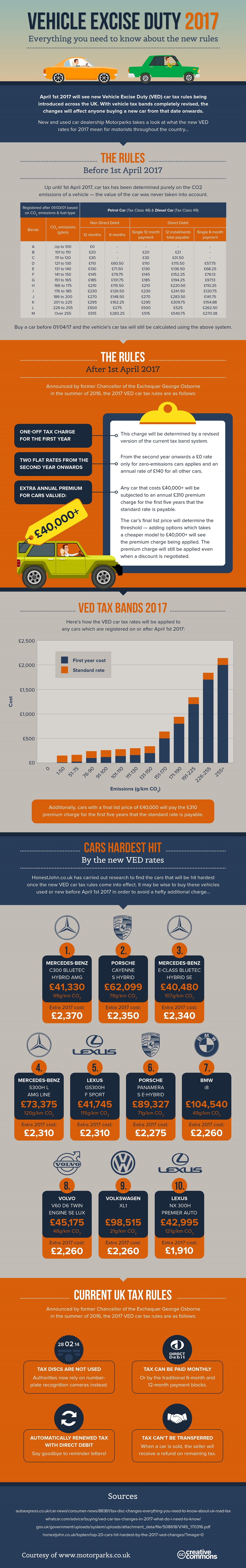

New rules coming into play as of April are set to shake up the UK car tax world. As we know it, VED has always been calculated based on the CO2 emissions from the vehicle. However, from April, VED will be determined based on the value of your vehicle.

Moving forward, the greater the value of your car, the more you are likely to pay for your car tax. Buyers who invest in a new car before April will have their car tax calculated as per the old rules - but following April 1st, the new rules will apply.

New and used car dealership Motorparkshas produced an easy-to-follow visual guide with all the information you need to know about the rule change, including which vehicles are likely to be hit the hardest by the new rules. For example, Volvo V60 buyers will pay up to £2,260 extra over time following the rule change.

Discover the infographic below so that you aren’t greeted with an expensive surprise when you invest in your next vehicle - or check out their online calculator to beat the road tax increase.

Moving forward, the greater the value of your car, the more you are likely to pay for your car tax. Buyers who invest in a new car before April will have their car tax calculated as per the old rules - but following April 1st, the new rules will apply.

New and used car dealership Motorparkshas produced an easy-to-follow visual guide with all the information you need to know about the rule change, including which vehicles are likely to be hit the hardest by the new rules. For example, Volvo V60 buyers will pay up to £2,260 extra over time following the rule change.

Discover the infographic below so that you aren’t greeted with an expensive surprise when you invest in your next vehicle - or check out their online calculator to beat the road tax increase.